unfiled tax returns 10 years

How to ship your tax return. Although it took a little over a year.

Catch Up With Unified Taxes In Canada Canadiantaxamnesty

You knew youd owe taxes and feared the consequences so you didnt file.

. Amending a previous tax return where you missed deductions or credits. Call for free consultation. The sale therefore triggers a capital gain of 200 half of which is taxable.

The profit from selling the acquired shares is a capital gain. From the Internal Revenue Services perspective things seem to have gone reasonably well. Terms and conditions may vary and are subject to change without notice.

It processed more returns by April 15 than it did in 2021 and issued more and larger refunds. If you have old unfiled tax returns it may be tempting to believe that the IRS or state tax agency has forgotten about you. So the tax cost of the acquired shares is 10 5 15.

A tax agent can be a. However if you do not file taxes the. Long lines the 13 ounce rule lack of convenient postal drop boxes lost mail and the aggravation of dealing with obnoxious government postal clerks.

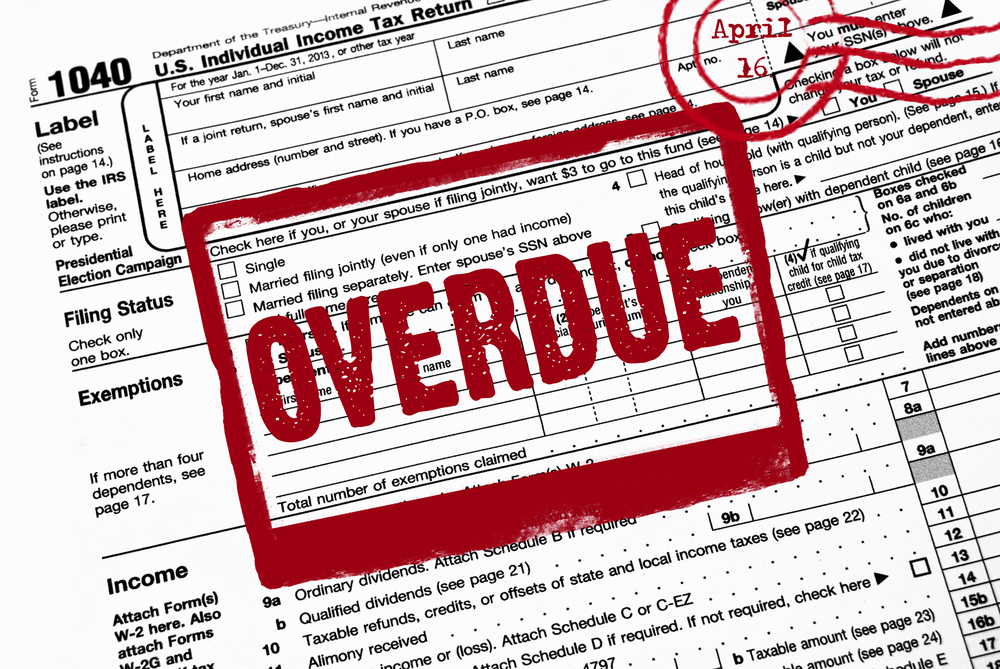

Confirm that the IRS is looking for only six years of returns. Nicks office got the IRS to settle with me for 10 of what they said I owed. Three consequences of unfiled returns.

You may amend your form within three years of the original or within two years of paying the tax reported on the form whichever is later. Challenging an IRS assessment for additional tax. The benefit from exercising an employee stock option is employment income.

Checks consist of the analysis of the taxpayers prior and subsequent year returns as well as related returns and unfiled returns. Farming Business Returns Accounting. How Is the ERC Claimed Retroactively.

The law requires you to file every year that you have a filing requirement. Close any tax deficiency years using Statutory Notice of Deficiency procedures. Have unfiled tax returns.

Our Experienced Professional and Knowledgeable Farm Tax Accountants have knowledge skills experience Training and Education needed to manage all your Farming Business Returns. An estate worth 127 million for example will face the estate tax on just 1 million. When evaluating the costs of not filing your return know these facts.

All gifts over the annual gift limit however have the potential to increase the estate tax. A tax agent must have a myIR account. The IRS doesnt pay old refunds.

Filling out a collection information statement and other financial information for larger debts. Lets break down the reality of the situation when you have unfiled back tax returns and exactly what to do about it. After years of fighting the IRS myself and getting deeper and deeper into debt with interest adding up to more than I owed to start with I had to do something.

The six year enforcement period for delinquent returns is found in IRS Policy Statement 5-133 and Internal Revenue Manual 1214118. Our experience is available to help you. Person in a business where income tax returns are prepared.

You will receive tax refunds for the years 2018 2019 2020 and 2021 if you are entitled to them. Say someone gives away 1 million to their child every year for 10 years and when they die in 2021 they have an estate worth 5 million. Make changes to your 2021 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312024.

Seeking a waiver or reduction in penalties. Remember these tips when youre filing back tax returns. Professional that carries out a service.

Call the IRS or your tax pro can use a dedicated hotline to confirm the unfiled years. The Post Office has become increasingly frustrating to deal with. Tax agents prepare the annual tax returns of income for 10 or more taxpayers.

There is generally a 10-year time limit on collecting taxes penalties and interest for each year you did not file. Why didnt you file your tax returns. Part of the reason the IRS requires six years is manpower the IRS cannot administer and staff the enforcement of unfiled tax returns going back as far as 10 or 20 years.

Ignoring for the time being the backlog on 2020 tax returns the IRS started the tax season on time and ended it on time for the first time in three years. Filing unfiled tax returns. The clients of a tax agent can be.

The instructions indicate lines 18 26 30 and 31 are those relative to ERC. After May 17th you will lose the 2018 refund as the statute of limitations prevents refunds after three years. Tax Year 2019 IRS Audit Rates by Income Level for Individuals Most Recent Data.

However you may still be on the hook 10 or 20 years later. When warranted the scope of the examination should be expanded to include considering the audit of. Realize because of the 3-year statute of limitations the percentage of returns audited will increase as other examinations are opened.

Tax Tips Capital Losses and Deferring Capital Gains from ESO Shares. Bomcas Canada Farm accounting and tax services designed to grow profits. If your return wasnt filed by the due date including extensions of time to file.

With TurboTax you can be confident your taxes are done right from simple to complex tax returns no matter what your situation. For example the 2016 IRS audit data showed an average audit rate of 52 for individual tax returns when previously it was 51. For additional information on tax payment options refer to Topic No.

You can only claim refunds for returns filed within three years of the due date of the return. You may amend your filings of Form 941 by filing amended tax returns using Form 941-X. If youre required to file and owe a balance but you cant pay all the tax due on your return the IRS may be able to help you establish a payment agreement.

Irs Letter 5972c You Have Unfiled Tax Returns And Or An Unpaid Balance H R Block

Late Or Unfiled Tax Help Get Help With Past Due Tax Returns We Can Help Minimize Or Even Avoid Late Filing Pe Tax Debt Debt Relief Programs Wage Garnishment

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

Unfiled Tax Returns Faris Cpa Toronto Tax Accountant

What Should I Do If I Have Years Of Unfiled Tax Returns Nj Taxes

What To Do If You Haven T Filed Taxes In 10 Years Debt Ca

What To Do If You Have Unfiled Tax Returns Irs Mind

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

Unfiled Tax Returns Mendoza Company Inc

Unfiled Tax Returns Notice Of Deficiency J David Tax Law

Is There A Penalty For Filing Taxes Late If You Don T Owe Late Tax Filing Liu Associates Edmonton Calgary

Unfiled Tax Returns Faris Cpa Toronto Tax Accountant

How To File Overdue Taxes Moneysense

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

Unfiled Taxes Md Va Pa Strategic Tax Resolution Filing Taxes Tax Extension Income Tax Return

Unfiled Tax Returns Tax Champions Tax Negotiation Services

How To Electronically Verify Your Income Tax Return Using Aadhar Income Tax Return Tax Return Income Tax