ct sales tax exemption form

STATE OF CONNECTICUT DEPARTMENT OF REVENUE SERVICES SALES USE TAX RESALE CERTIFICATE Issued to Seller Address I certify that Name of Firm Buyer is engaged as a registered Wholesaler Retailer Street Address or PO. 12-412 5 C Sales of goods and services to and by nonprofit organizations exempt from federal income tax.

Applicable to certain services prior to June 30 1987.

. Find out more about the available tax exemptions on film video and broadcast productions in Connecticut. D Exempt entity did not provide proof of exempt status. Items Printable Connecticut Sales Tax Exemption Certificates Added 11 hours ago The state of Connecticut provides a great many forms to be used when you wish to purchase tax-exempt items such as groceries college level textbooks or motor vehicles The Materials Tools and Fuel certificate should be utilized to.

Manufacturing and Biotech Sales and Use Tax Exemption. Wisconsin sales and use tax fillable form. In order to qualify for the sales tax exemption a farmer must first apply with the Department of Revenue Service DRS by filing Form REG 8.

CT-EITC - If you filed 2020 Schedule CT-EITC Connecticut Earned Income Tax Credit along with your 2020 Form CT-1040 Connecticut Income Tax Return on or before December 31 2021 you may be eligible for. In Connecticut certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. 12-41260 Motor vehicles sold to limited liability companies or their members in connection with the organization or termination of the limited liability company provided the last taxable sale was subject to tax.

Ad Download Or Email CT DRS More Fillable Forms Register and Subscribe Now. A purchaser must give the seller the properly completed certificate within 90 days of the time the sale is made but preferably at the time of the sale. Electronic filing is free simple secure and accessible from the comfort of your own home.

For other Connecticut sales tax exemption certificates go here. Factors determining effective date thereof. A sales tax exemption certificate is needed in order to make tax-free purchases of items and services that are taxable.

A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Connecticut sales tax. This page discusses various sales tax exemptions in Connecticut. Learn about a five-year 100 property tax.

12-412 5 B Sales to certain acute care for-profit hospitals. CT ExemptNon-Exempt Status More Fillable Forms Register and Subscribe Now. See if your manufacturing or biotech company is eligible for a 100 or 50 tax exemption.

Purchases of Tangible Personal Property and Services by Qualifying Exempt Organizations. While the Connecticut sales tax of 635 applies to most transactions there are certain items that may be exempt from taxation. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Connecticut sales tax.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. How to use sales tax exemption certificates in Connecticut. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to.

Wi tax exempt template is a sample template document that shows the process of designing wi. You can download a PDF of the Connecticut General Sales Tax Exemption Certificate Form CERT-100-B on this page. To obtain a Connecticut sales tax exemption certificate Form CERT-119 for a purchase other than meals and lodging contact the Tax Department 203-432-5530.

Exemption from sales tax for items purchased with federal food stamp coupons. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Connecticut sales tax. Connecticut exemption permit number or IRC.

Contact the Tax department for a resale certificate. Manufacturing Machinery and Equipment Tax Exemption. Exemption from sales tax for services rendered between parent companies and wholly-owned subsidiaries.

Form CT-10 Commonwealth of Virginia Communications Sales and Use Tax Certificate of Exemption For use by a purchaser who purchases communications services for resale an Internet service provider the Commonwealth of Virginia any political subdivision of the Commonwealth and the federal government. You can download a PDF of the Connecticut Resale Exemption Certificate Form CERT-100 on this page. This includes most tangible personal property and some services.

CT-EITC - If you filed 2020 Schedule CT-EITC Connecticut Earned Income Tax Credit along with your 2020 Form CT-1040 Connecticut Income Tax Return on or before December 31 2021 you may be eligible for the 2020 EITC Enhancement Program click here for more information. Sales tax relief for sellers of meals. Ad Download Fill Sign or Email the file More Fillable Forms Register and Subscribe Now.

CERT-119 should not be used for purchases that are made for resale. On making an exempt purchase Exemption Certificate holders may submit a completed Connecticut Sales Tax Exemption Form to the vendor instead of paying sales tax. The application is then either approved or denied.

12-412 5 A Sales by nonprofit organizations on hospital premises. Click here for Income tax filing information. In limited circumstances the University may purchase items for resale.

You can download a PDF of the Connecticut Purchases of Tangible Personal Property and Services by. State Of Connecticut Exemption Certificate Gain. If approved form OR-248 Agricultural Sales Tax Exemption Permit is issued.

Manufacturer Lessor Other specify City State Zip. - Click here for updated information. Sales Tax Exemptions in Connecticut.

For other Connecticut sales tax exemption certificates go here. Sales to and by nonprofit charitable hospitals nursing homes rest homes residential care homes. The purchaser must complete CERT-125 Sales and Use Tax Exemption for Motor Vehicle or Vessel Purchased by a Nonresident of Connecticut Conn.

Sales tax exemption forms as well as business sales tax id applications sales tax returns and the full Connecticut sales tax code can be downloaded from the Connecticut Department of Revenue. 50lc3 4 or 13 determination letter and license issued by the Department of Public Health if applicable D Exempt entity will not be directly invoiced and charged by the retailer of the meals or lodging. Complete Edit or Print Tax Forms Instantly.

The form must be forwarded to Taxpayer Services at DRS for review.

Printable Connecticut Sales Tax Exemption Certificates

Online Sales Tax Compliance Ecommerce Guide For 2022

Sales Tax Exemption For Building Materials Used In State Construction Projects

Form Reg 8 Fillable Farmer Tax Exemption Permit

Glass Wood House House In The Woods Canopy Architecture Diy Canopy

How To Get A Resale Certificate In Connecticut Startingyourbusiness Com

Business Leaders Think These Are The Best States For Education Business Leader Education Historical Maps

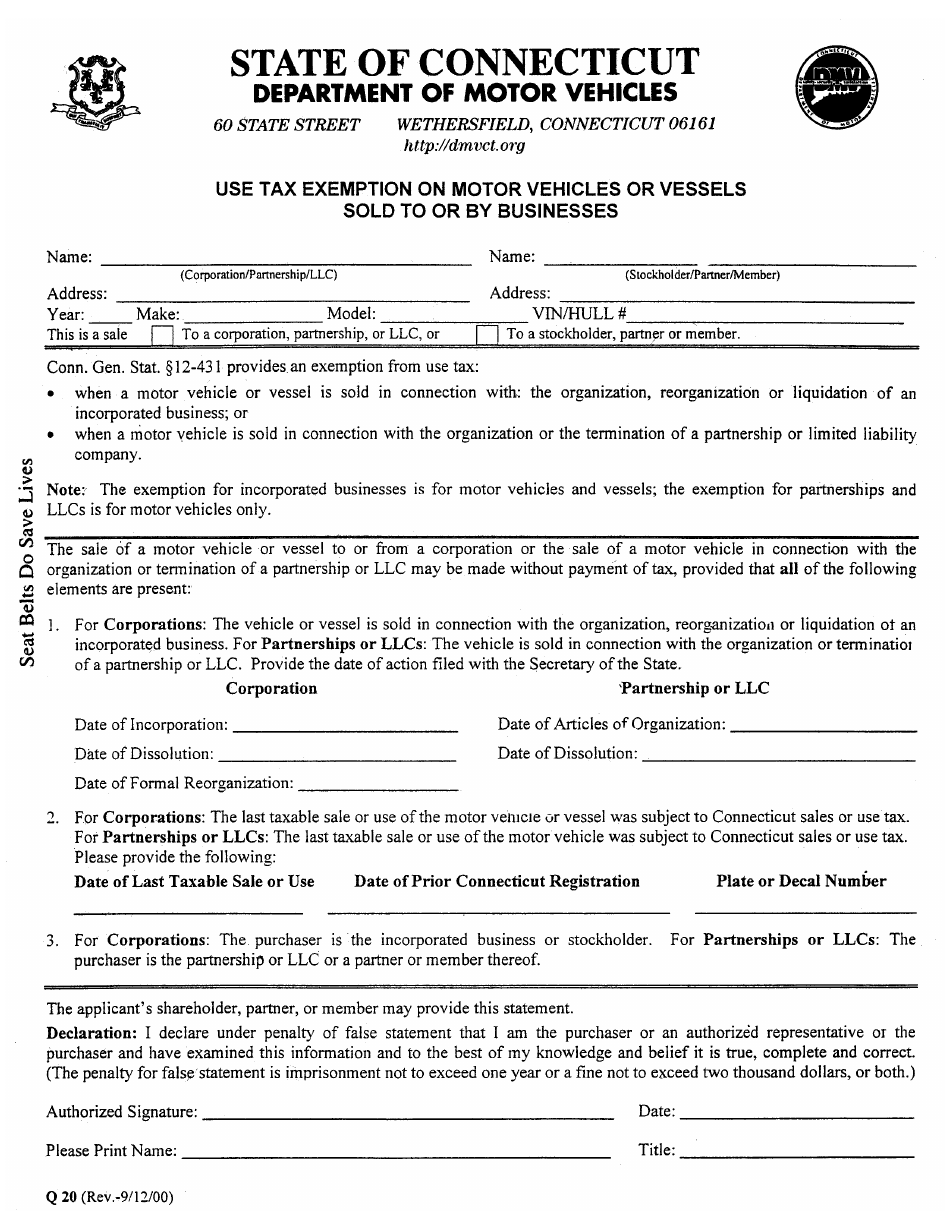

Form Q 20 Download Fillable Pdf Or Fill Online Use Tax Exemption On Motor Vehicles Or Vessels Sold To Or By Businesses Connecticut Templateroller